INVESTMENT ?

In general, to invest is to distribute money in the expectation of some benefit in the future (for example doing investment in durable of goods, in real estate by the service industry, in product development, in research and development and in factories for manufacturing. However, here I'm focuses specifically on investment in financial assets.

In finance, the benefit from investments is known a 'return'. The return may consist of a profit from the sale of property or an investment, or investment income including dividends, interests, rental income (house, room, car) or combination of the two. The projected economic return is the appropriately discounted value of the future returns.

Investors generally expect higher returns from riskier investments. When we make a low risk investment, the return is also generally low income also.

Investors, particularly novices, are often advised to adopt a particular investment strategy and diversity their portfolio. Diversification has the statistical effect or reducing overall risk.

Investment are differs from arbitrage, in which profit is generated without investing capital or bearing risk. An investor may bear a risk of loss of some or all of their capital invested, whereas in saving the risk of loss in the value that is stated on a coin or note is normally remote.

Investment in stocks, property, in the hope of significant gain but with the risk of significant loss-speculation, involves a level of risk which is greater than most investors would generally consider justified by the expected return. An alternative characterization of speculation is its short-term opportunistic nature.

WHAT ARE THE TYPES OF INVESTMENT?

1. Stocks

When you buy shares of a company’s stock, you own a piece of that company. Stocks come in a wide variety, and they often are described based the company’s size, type, performance during market cycles and potential for short- and long-term growth. Learn more about your choices—from penny-stocks to large caps and more.

2. Bonds

A bond is a loan an investor makes to an organization in exchange for interest payments over a specified term plus repayment of principal at the bond’s maturity date. Learn how corporate, muni, agency, Treasury and other types of bonds work.

3. Investment Funds

Funds—such as mutual funds, closed-end funds and exchange-traded funds—pool money from many investors and invest it according to a specific investment strategy. Funds can offer diversification, professional management and a wide variety of investment strategies and styles. But not all funds are the same. Understand how they work, and research fund fees and expenses.

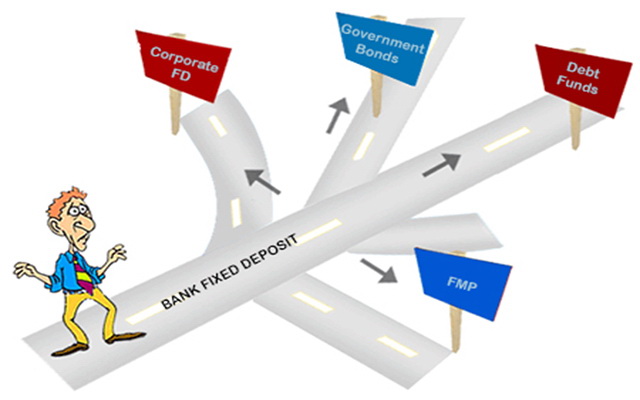

4. Bank Products

Banks and credit unions can provide a safe and convenient way to accumulate savings—and some banks offer services that can help you manage your money. Checking and savings accounts offer liquidity and flexibility. Find out more about these and other bank products.

5. Annuities

An annuity is a contract between you and an insurance company, in which the company promises to make periodic payments, either starting immediately—called an immediate annuity—or at some future time—a deferred annuity. Learn about the different types of annuities.

6. Options

Options are contracts that give the purchaser the right, but not the obligation, to buy or sell a security, such as a stock or exchange-traded fund, at a fixed price within a specific period of time. It pays to learn about different types of options, trading strategies and the risks involved.

7. Savings For College

Funding college begins with savings, starting with how much to save. Learn the many, smart ways to save for college, including 529 College Savings Plans and Coverdell Education Savings Accounts. We’ll help you navigate your college savings options.

8. Security Futures

Federal regulations permit trading in futures contracts on single stocks, also known as single stock futures, and certain security indices. Learn more about security futures, how they differ from stock options and the risks they can pose.

9. Retirement

Numerous types of investments come into play when saving for retirement and managing income once you retire. For saving, tax-advantaged retirement options such as a 401(k) or an IRA can be a smart choice. Managing retirement income may require moving out of certain investments and into ones that are better suited to a retirement lifestyle.

10. Insurance

Life insurance products come in various forms, including term life, whole life and universal life policies. There also are variations on these—variable life insurance and variable universal life—which are considered securities. See how insurance products may fit into an overall financial plan.

11. Commodity Futures

Commodity futures contracts are agreements to buy or sell a specific quantity of a commodity at a specified price on a particular date in the future. Commodities include metals, oil, grains and animal products, as well as financial instruments and currencies. With limited exceptions, trading in futures contracts must be executed on the floor of a commodity exchange.

12. Alternatives and Complex Products

These products include notes with principal protection and high-yield bonds that have lower credit ratings and higher risk of default than traditional investments, but offer more attractive rates of return. Learn about their features, risks and potential advantages.

13. Initial Coin Offerings and Cryptocurrencies

|

| https://www.jacknjillscute.blogspot.com/ |

These are speculative investments that come with significant uncertainty and many risks. Before you consider an investment in ICOs or cryptocurrencies.

HOW DO I START TO INVEST MY MONEY?

Many people put off investing because they think you need a lot of money—thousands of dollars!— to start investing. This just isn’t true. You can start investing for as little as $50 per month.

The key to building wealth is developing good habits—like regularly putting money away every month. If you make investing a habit now, you’ll be in a much stronger financial position down the road.

Don’t believe me? Here are five ways you can start investing with very little money:

1. PLAY IT SAFE WITH TREASURY SECURITIES

|

| https://www.jacknjillscute.blogspot.com/ |

Not many small investors begin their investment journey with US Treasury securities, but you can. You’ll never get rich with these securities, but it is an excellent place to park your money—and earn some interest—until you are ready to go into higher risk/higher return investments.

Treasury securities, also known as savings bonds, are easy to buy through the US Treasury’s bond portal Treasury Direct. There you can buy fixed-income US government securities with maturities of anywhere from 30 days to 30 years in denominations as low as $100.

You can also use Treasury Direct to buy Treasury Inflation Protected Securities, or TIPS. These not only pay interest, but they also make periodic principal adjustments to account for inflation based on changes in the consumer price index.

And as is the case with mutual funds, you can also arrange to have your Treasury Direct account funded through payroll savings.

2. PUT YOUR MONEY IN LOW - INITIAL - INVESTMENT MUTUAL FUNDS

|

| https://www.jacknjillscute.blogspot.com/ |

Mutual funds are investment securities that allow you to invest in a portfolio of stocks and bonds with a single transaction, making them perfect for new investors.

The trouble is many mutual fund companies require initial minimum investments of between $500 and $5,000. If you’re a first-time investor with little money to invest, those minimums can be out of reach. But some mutual fund companies will waive the account minimums if you agree to automatic monthly investments of between $50 and $100.

Automatic investing is a common feature with mutual fund and ETF IRA accounts. It’s less common with taxable accounts, though its always worth asking if it’s available. Mutual fund companies that have been known to do this include Dreyfus, Transamerica, and T. Rowe Price.

An automatic investing arrangement is particularly convenient if you can do it through payroll savings. You can typically set up an automatic deposit situation through your payroll, in much the same way that you do with an employer-sponsored retirement plan. Just ask your human resources department how to set it up.

3. ENROLL IN YOUR EMPLOYER'S RETIREMENT PLAN

|

| https://www.jacknjillscute.blogspot.com/ |

If you’re on a tight budget, even the simple step of enrolling in your 401(k) or other employer retirement plan may seem beyond your reach. But there is a way that you can begin investing in an employer-sponsored retirement plan with amounts that are so small you won’t even notice them.

For example, plan to invest just 1 percent of your salary into the employer plan.

You probably won’t even miss a contribution that small, but what makes it even easier is that the tax deduction that you’ll get for doing so will make the contribution even smaller.

Once you commit to a 1 percent contribution, you can increase it gradually each year. For example, in year two, you can increase your contribution to 2 percent of your pay. In year three, you can increase your contribution to 3 percent of your pay, and so on.

If you time the increases with your annual pay raise, you’ll notice the increased contribution even less. So if you get a 2 percent increase in pay, it will effectively be splitting the increase between your retirement plan and your checking account. And if your employer provides a matching contribution, that will make the arrangement even better.

Again, Betterment is a great tool for hands-off investment management of your 401(k). If you want to take a more active approach to managing your 401(k), we’d recommend a service like Ally Invest – perfect for frequent traders looking for one of the lowest fee structures of any major brokerage firm.

4. LET BETTERMENT INVEST YOUR MONEY FOR YOU

Betterment is an automated investment platform that’s cheap and super easy to use.

When you invest your money with Betterment, the site sets you up with a portfolio that includes several exchange traded funds (ETFs).

Betterment figures out how to invest your money for you based on a short questionnaire. Investment management is actually performed by the platform, as this is not a do-it-yourself account where you buy and sell your own choice of securities.

Betterment is the perfect platform if you are new to investing and don’t have a large amount of money to open an account. Not only will Betterment handle the investing for you, but there is no minimum deposit amount to open an account and you can contribute as little as $10 at a time.

Fees are also very reasonable at .25 percent on all accounts up to $2 million (there is a 0.10% fee reduction beyond $2MM invested). They also offer access to Certified Financial Planners® on balances of at least $100,000 for additional fees

.

Betterment: The Way Investing Should Be

Betterment Low-fee roboadvisor with no minimum investment. Creates fully-automated portfolios based upon your desired allocation.

5. TRY THE COOKIE JAR APPROACH

|

| https://www.jacknjillscute.blogspot.com/ |

Saving money and investing it are closely connected. In order to invest money, you first have to save some up. That will take a lot less time than you think, and you can do it in very small steps.

If you’ve never been a saver, you can start by putting away just $10 per week. That may not seem like a lot, but over the course of a year it comes to over $500.

Try putting $10 into an envelope, shoebox, a small safe, or even that legendary bank of first resort, the cookie jar. Though this may sound silly, it’s often a necessary first step. Get yourself into the habit of living on a little bit less than you earn, and stash the savings away in a safe place.

The electronic equivalent of the cookie jar is the online savings account; it’s separate from your checking account. The money can be withdrawn in two business days if you need it, but it’s not linked to your debit card. Then when the stash is large enough, you can take it out and move it into some actual investment vehicles.

Start with small amounts of money, and then increase as you get more comfortable with the process. It may be a matter of deciding not to go to McDonald’s or passing on the movies, and putting that money into the cookie jar instead.

Prefer that money to be invested right away? Acorns is an app that rounds up your credit and debit card purchases and invests the difference.

It’s not fancy, but it’s a start. And for people who’ve never been savers, getting that start is all the more important.

WHICH INVESTMENTS HAVE THE BEST RETURN ?

#1 -PEER TO PEER LENDING

|

| https://www.jacknjillscute.blogspot.com/ |

With these companies, you’re able to loan money to individuals in small increments as if you were the bank. The best part is, you get to earn a pretty decent rate of return – usually upward of 6% or more.

As an investor in peer - to - peer lending, you’re investing in other people and their goals. It's comforting knowing you aren’t lending people you don’t know large sums of money. Instead, the money you invest is split up into increments as small as $25 over hundreds or even thousands of loans.

While it may seem strange to hear a financial advisor suggest people invest in peer-to-peer lending, I’m not the only one who sees the value in these platforms. Kansas City Financial Advisor Clint Haynes told me he supports peer-to-peer lending as an alternative to the stock market for a few reasons. First, these companies make it easy to sign up and get started. Second, your rate of return can range from 5 – 7 percent for safer loans and even more for riskier loans. Last but not least, you can typically open a new account with as little as $1000.00.

#2 -REAL ESTATE

|

| https://www.jacknjillscute.blogspot.com/ |

In addition to the stock market and peer-to-peer lending websites, a second investment strategy to consider this year is real estate. The thing is, I’m not suggesting everyone run out and buy an investment property. After all, not everyone is cut out to be a landlord.

I’m certainly not. I tried investing in physical real estate seven years ago and almost lost my shirt. I learned a lot of lessons from my foray into becoming a landlord, the biggest of which was that I don’t need that kind of stress in my life.

Fortunately, there are plenty of ways to invest in real estate without dealing with a physical property. One option to consider is investing in real estate notes. I got started investing into real estate notes because a really good friend of mine was crushing it with real estate and offering his friends the chance to invest.

He would buy a pool of real estate properties, and then investors like myself would invest money into his project. From there, he would manage the properties and pay me a dividend or interest off that money. For me, this has been an attractive way to invest money without having to be a landlord or deal with tenants.

Obviously, there is a ton of risk in a situation like this. You have to have a lot of trust to invest in real estate notes offered by an individual.

The good news is, there are other ways to invest in real estate outside of real estate notes. One option I’m really excited about is a company called Fundrise. Fundrise offers an investing scenario similar to the one above. They buy commercial properties and allow investors to invest small sums of money. Obviously, this is yet another hands-off investment. You may own part of a commercial real estate project, but you don’t even see or deal with the property itself.

Like Lending Club, Fundrise requres an upfront sum of around $1,000.00 to get started. Once you invest, however, Fundrise mostly lets you “set it and forget it.” Even better, you may receive a pretty hefty rate of return through this platform. On the company website, Fundrise claims its returns have averaged between 8.76% up to 12.42% over the last five years. Not too shabby.

Obviously, there is risk investing in a platform like this one, too. First off, the company is newer so it doesn’t have decades of data to share. Second, you’re letting a third party choose buildings and investments on your behalf, which means you’ve given up all control.

Regardless, I think it’s pretty cool that technology has allowed investors to get access to commercial properties in a way we haven’t been able to in the past.

#3 -INVEST IN YOU

|

| https://www.jacknjillscute.blogspot.com/ |

This third options - investment option might sound cheesy, but it’s one of the best investments anyone can make.

Believe it or not, there are a ton of ways to invest in yourself that don’t cost a ton of cash at all. One of the best ways to improve yourself could even befree if you have a library.

That’s right; read a ton of books! But, how many should you read? Minneapolis Financial Planner Morgan Ranstrom says that reading three to five books on successful personal finance strategies or leadership skills will absolutely make you smarter over the course of a few months.

If you have more time, you could read even more than that. If you’re not sure what to read, you could even consider signing up for Leaderbox – a monthly subscription service that includes books and leadership strategies curated by thought leader Michael Hyatt.

#4 -THE STOCK MARKET

|

| https://www.jacknjillscute.blogspot.com/ |

While “invest in the stock market” is some of the most basic advice you’ll ever read, please hear me out on this one. While everyone knows that investing in the stock market has historically paid off, there are far too many people who don’t trust the financial markets and choose to sit on the sidelines altogether.

Then there are people who think the stock market is so overvalued right now that they would be crazy to jump in. But, here’s the thing: Instead, I’m suggesting you invest small sums of money over time using a method called “dollar cost averaging.”

Dollar cost averaging requires us to trickle our money into investments over any length of time. It could be 12 months. It would be 18 months. Heck, it could be five years.

Colorado financial advisor David Henderson of Jenkins Wealth goes further to explain how dollar cost averaging works: “When the market is high, you buy fewer shares and when the market is low you buy more shares,” he says. This means that, over time, you will have a lower average share price using this method. Obviously, it’s easy to see why this would be beneficial.

Now that we’ve talked about the importance of investing in the stock market, let’s talk about exactly where to invest your money. What are the best tools and vehicles we can use?

This is yet another situation where the options are overwhelming. Still, I typically suggest people get their feet wet with mutual funds or ETFs.

If you have a financial advisor working on your behalf, they may be able to weed out the well-performing actively managed mutual funds from the ones that aren’t doing so great. Otherwise, you can invest in index funds, which are not actively managed but have a long history of solid returns.

If you have a brokerage account already, then you may want to stick with it. Otherwise, you’ll need to find a new place to help you invest your funds. One company I always suggest is Betterment. With Betterment, your money can be invested in ETFs and they don’t charge a fee for managing these for you. Plus, they actually pick the ETFs you invest in based on your appetite for risk, investing goals, and other factors.

What does that mean? That means that you can invest your hard-earned money, then sit back and enjoy the returns and let them do the hard work.

If you want to have more control on your investments, online brokerage firms like Ally Financial, TD Ameritrade and E-Trade make it easy to stay in charge with low fees and easy-to-use platforms. Plus, there are a multitude of other "robo-advisors" to choose from.

As a final note, there’s one more simple way to invest in the stock market with even less effort – boosting how much you contribute to your work-sponsored retirement account. Arizona financial planner Charles C. Scott says this may be your best option yet – especially if you’re not contributing enough to get a match from your employer.

“Every dollar you contribute could get a dollar match,” says Scott. “That’s a 100% return on your investment.”

If you’re not making the most of your 401(k) or contributing enough to get a match, then you’re probably best starting there.

SUMMARY

There are plenty of ways to start investing with little money, with many online and app based platforms making it easier than ever. All you have to do is start somewhere. Once you do, it will get easier as time goes on, and your future self will love you for it!

YOU CAN READ SOME ARTICLES RELATED TO HOW TO MAKE YOUR OWN MONEY FROM THIS BLOG.

JUST CLICK LINK BELOW TO READ >>>

@ Jackie San